- What We Do

- Understanding your audience

- Engaging new audiences

- Designing experiences

- Building loyalty

Audience Atlas Boston 2018 vs 2023 deep dive

In August 2023, an arts museum in Boston commissioned a new iteration of our 2018 Audience Atlas Boston study to understand how the cultural landscape of Boston has changed post-pandemic.

Audience Atlas is a targeted online survey of the population in a particular city, region or country, exploring the market for culture (defined as anyone who has engaged in any type of cultural activity in the last five years, or would be open to doing so in the future). It includes detailed information about audience demographics, behaviors, motivations and attitudes which enables us to accurately determine current, lapsed and potential market sizes for culture.

So what’s changed over the last five years? Here are our key findings:

The market for culture is smaller and less active than in 2018

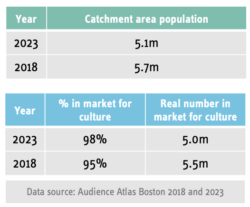

The Boston Metro area saw a sharp population decline during the pandemic, so although the market for culture is proportionally larger (98% in 2023, compared to 95% in 2018), in real figures there are 449k fewer people in the market in 2023.

Additionally, those that are in the market for culture are less active. If we look at art museum visitation specifically, 13% said they had visited 2 or more times in the past 12 months, and 14% once in the past 12 months, compared to 20% and 21% respectively in 2018. 30% said they hadn’t visited an art museum for at least three years, up from 19% in 2018.

One in 10 now consider arts and culture to be less important to them and are prioritizing activities at home, online and in nature

We asked respondents how important they felt arts and culture were to them pre-pandemic and now.

18% overall felt arts and culture were less important to them now than pre-pandemic. 10% of this group were those who previously felt arts and culture was important to them. While this is not a huge proportion of the market overall, it is important to acknowledge that the pandemic has made a real impact on how culture fits into priorities for some.

We also gave respondents a list of activities and asked them to tell us whether they felt they were doing these things more, less or the same now as they had pre-pandemic. We subtracted the ‘less’ responses from the ‘more’ to produce a net score for each activity.

We also gave respondents a list of activities and asked them to tell us whether they felt they were doing these things more, less or the same now as they had pre-pandemic. We subtracted the ‘less’ responses from the ‘more’ to produce a net score for each activity.The activities with the highest net scores were those involving spending time at home, online and in nature. These activities became the norm, given Covid-19 mandates and regulations and post-pandemic it seems they’ve stuck.

Contrastingly, going out to restaurants, visiting museums and attending performing arts productions all received negative net scores from participants overall. The pandemic has resulted in many being out of the habit of visiting cultural organizations, even if they were a regular visitor pre-pandemic.

Significantly higher proportion of Expression

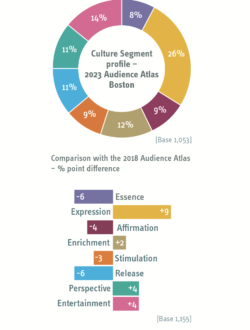

There has also been a shift in the Culture Segment profile of those in the Boston Metro Area. If you’re not already familiar with our Culture Segment system, you can find a quick intro on our website.

In 2018, 17% of those in the Boston market for culture were in the community-minded Expression segment, and a further 17% fell into the time-poor Release segment. 14% were core cultural attenders Essence and 13% self improvement-focused Affirmation.

In 2018, 17% of those in the Boston market for culture were in the community-minded Expression segment, and a further 17% fell into the time-poor Release segment. 14% were core cultural attenders Essence and 13% self improvement-focused Affirmation.However, in 2023 we saw a shift: Expression now make up over a quarter of the market, while the proportion of those in the Essence, Release and Affirmation segments have declined significantly. Given what we already know about Expression, this may mean that the Boston market for culture is now more focused on community and making sure everyone is welcomed and included, as well as taking part and getting involved in a variety of art forms.

Those who are deeply engaged are willing to invest time and effort…

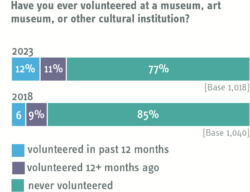

Despite lower engagement with museums and performing arts organisations post-pandemic, the proportion of those within the market for culture who said they’d volunteered at a museum, art museum or other cultural organization actually increased in 2023.

12% said they’d volunteered in the past 12 months, compared to 6% in 2018. 11% had volunteered in the past, but not in the last 12 months (compared to 9% in 2018).

Although arts and culture is now less important to some, those who consider it a priority are willing to invest time and effort in supporting the organizations they love.

…but cost of living crisis may be impacting ability to give and join

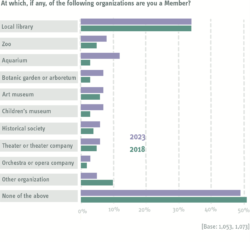

Donations to cultural organizations has remained static compared to 2018. 24% said they’d donated money, compared to 25% in 2018. Uptake of membership at cultural organizations has also remained consistent; in 2018 49% held membership at a cultural organization, compared to 51% in 2023.

We already know the cost-of-living crisis is affecting many in the US and internationally; a 2023 report published by Indiana University’s School of Philanthropy (using data collected by Giving USA) found that total charitable giving decreased by 3.4% in 2022 across the USA. This represents one of only four instances of a decrease in total charitable giving in the past 40 years. It’s possible that many within the Boston market for culture are simply finding themselves without the disposable income to donate to and join cultural organizations.

Outro

Through a comparison of our 2023 and 2018 Boston Audience Atlas datasets we observed that the market for culture has shrunk (in terms of real figures), and those within the market are less active. The activities which became the norm during the pandemic (spending time at home, online and in nature) have stuck, and people have gotten out of the habit of visiting museums and performing arts organizations.

Coming soon, we’ll be sharing more Audience Atlas Boston content, including some tactics and recommendations for organizations in Boston to tackle these new challenges. If you have any questions, or you’d like to talk to us about how we might be able to help your organization, please contact roisin.coleman@mhminsight.com

Add your details below

Download the full report

Fill in your information to get an instant download of the full Audience Atlas Boston report.

Read more about Audience Atlas

Learn moreFour reopening insights from Audience Atlas DC

MHM’s Washington DC Audience Atlas report, published in February 2021, focuses heavily on how the pandemic is affecting people’s cultural habits, motivations and future intentions. Read four actionable insights, download the report and watch our webinar.

Learn moreUsing psychographics to change the demographic profile of your audience

Director of our US Team, Lorna Dennison, explains how you can use psychographics to change the demographic profile of your audience.

Learn moreAudience Atlas New York 2021

In November 2021 we published the latest insights from our large-scale study of New York audiences: Audience Atlas. Watch our webinar, read the report and find out about the whole market for the New York metropolitan area, including those who aren't yet cultural attenders but could be persuaded to do so.

- Engaging new audiences

- Understanding your audience